August 6, We went to Manila on a business trip with my mom and younger sister (an apprentice and is learning the ropes of real estate). She recently finished her studies and just arrived fresh from the U.S. after a 3 week vacation mixed with business and pleasure. I was able to join them on the 2nd General Brokers Assembly for the second quarter of Alveo Land Corp., An Ayala Land company, which was formerly known as Community Innovations, Inc or CII for short. We were invited by one of the Brokers network coordinator the other day and the venue will take place at Bonifacio High Street, Bonifacio Global City, Taguig.

Alveo Land Corp (formerly Community Innovation, Inc.) was a young upstart company of Ayala Land Inc. (ALI) back in the early 2000 and has been in the forefront on the mixed residential developments ranging from horizontal to vertical projects wherein one of their top selling properties are Two Serendra in Bonifacio Global City, The Columns in Makati CDB just to name a few of their projects has achieved P 60 Billion pesos through its combined sales of their project in the whole Philippines with achieving a first quarter profit of % by Ayala Land Inc as reported by Mr. Robert Lao, deputy head of sales of Alveo Land Corp.

Mr. Dan Abando, president of Ayala Land Inc. together with Mr. Rex Mendoza, Senior Vice President of Ayala Land Inc. were present on the meeting together with the movers and shakers of the company, their accredited real estate brokers and their respective companies that are business partners with the Ayala Land. The top 10 brokers were presented and given awards and gifts for their support with Ayala's vision of developing the landscape and venturing into real estate which gave them lots of opportunities.

Mr. Rex Mendoza gave a small talk on Real Estate Investing in Tough Times in which he gave some details to help the sales people achieve their goals of selling to customers on bearish market and boosting sales of their properties. "The people are capable of buying anything but they are afraid of uncertainties lying ahead with dark clouds" as what Mr. Mendoza said. You see, customers are on a "wait and see effect" of the economy.

Mr. Rex Mendoza gave a small talk on Real Estate Investing in Tough Times in which he gave some details to help the sales people achieve their goals of selling to customers on bearish market and boosting sales of their properties. "The people are capable of buying anything but they are afraid of uncertainties lying ahead with dark clouds" as what Mr. Mendoza said. You see, customers are on a "wait and see effect" of the economy.

Monthly Peso per US $ Rate (January 1997 - June 2008)

Monthly Peso per US $ Rate (January 1997 - June 2008)

LATEST: P 44.281 /US$ (June 2008)

HIGH: P 56.341/US$ (October 2004)

LOW: P 24.2648/US$ (December 1994)

Interbank Call Loan Rate

Interbank Call Loan Rate

(January 1991 to June 2008)

Latest: 5.27 % (June 2008)

High: 21.1 % (January 1998)

Low: 6.9 % (July 2003)

91-day T-Bill Rates (Updated 18 June 2008)

91-day T-Bill Rates (Updated 18 June 2008)

Latest: 3.67 % (January 2008)

High: 15.8 % (November 2000)

Low: 4.4 % (May 2002)

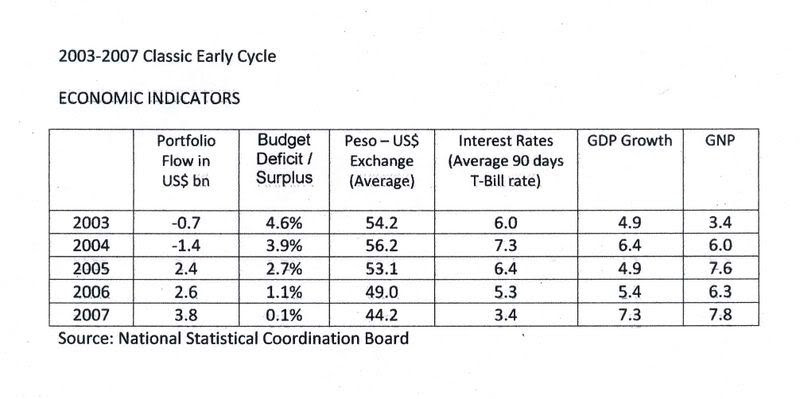

Mr. Mendoza recently showed some slide presentations adapted from Anton Periquet's presentations to Ayala's top brass a few weeks ago (Anton Periquet is a Deutsche Regis Partners Country Strategist). Just citing an example from last year, A lot of people in 2007 doubled their net worth overnight upon investing in stock market, mutual funds and others during the bull run of early 2007 but somehow upon reaching the late 2007 to the early 2008 a lot of the same people who invested were left with one half to one third of their net worth to losing streak. In 2007, people are thinking that they are rich because of their purchasing power but at present times people are belt tightening or afraid to invest, he asked us if the "Good Times are Over?".

People tend to ask the same old question of What now?, What do next? So people backtrack and not engage again meaning market needs excuses for movement and ask for stimulus on which inflexion point occur. The Philippine Stock Exchange Index is signalling another economic inflexion point. Mr. Mendoza reiterated that history repeats itself setting an example of 1997 Asian Financial Crisis (or Asian Flu of 1997) wherein Asian tiger economies like Japan, Singapore, Thailand, Philippines and other countries where hit hard but manage to survive the tough times and make a rebound in the process. He also pointed the psychological problem of the investor on How Long this problem will stay? Wherein there are two pre-requisites that should make the world economy stabilize on which 1.) Global Risk Appetite Normalize; 2.) Domestic Trigger Surfaces.

Along the meeting, he discussed the Virtous Cycle Unwinds that affected the world wherein there were two shocks experienced globally in late 2007 to present times. First of all is the U.S. SUBPRIME CRISIS brought about by CREDIT CRUNCH which was brought about by bad practice of lending and financing wherein they lent their money to those with poor credit (see through Investopedia). The second is OIL, in the past few months there have rising fuel prices but somehow a few days ago, the oil market and trading have recently decrease to US$ 115 per barrel and I am hoping it will go down sharply. The two shocks affected our real estate buyers from abroad specifically the Filipino-Americans who were our main investors but here in the Philippines and other overseas Filipinos from other parts of the world are not affected by the U.S. Subprime Crisis because our local banks are asking for primary collaterals (land titles, bank certificates, stock certificates etc) before issuing and approving a client a loan (very strict rules) so it is a different story from what is happening in the U.S. wherein the lenders can lend you money as long you are breathing with no collateral before the housing bubble burst.

There is a growing consciousness among the public in investing in real estate to hedge against inflation wherein a property is still the best option in long terms with capital appreciation. Right now mortgage rates from banks remains low with major banks competing in giving the lowest rates to potential customers, Peso - Dollar Exchange Rate is still stable and positive economic outlook in 2009 and Filipinos as most Asians regard property as a primary investments.

There maybe crisis in these rough times but some people see opportunities in times ahead.

"THERE IS NO FUTURE IN SHORT TERM".

Copyright 2008-2009 - PinoyMoneyVantage

Alveo Land Corp (formerly Community Innovation, Inc.) was a young upstart company of Ayala Land Inc. (ALI) back in the early 2000 and has been in the forefront on the mixed residential developments ranging from horizontal to vertical projects wherein one of their top selling properties are Two Serendra in Bonifacio Global City, The Columns in Makati CDB just to name a few of their projects has achieved P 60 Billion pesos through its combined sales of their project in the whole Philippines with achieving a first quarter profit of % by Ayala Land Inc as reported by Mr. Robert Lao, deputy head of sales of Alveo Land Corp.

Mr. Dan Abando, president of Ayala Land Inc. together with Mr. Rex Mendoza, Senior Vice President of Ayala Land Inc. were present on the meeting together with the movers and shakers of the company, their accredited real estate brokers and their respective companies that are business partners with the Ayala Land. The top 10 brokers were presented and given awards and gifts for their support with Ayala's vision of developing the landscape and venturing into real estate which gave them lots of opportunities.

Monthly Peso per US $ Rate (January 1997 - June 2008)

Monthly Peso per US $ Rate (January 1997 - June 2008)LATEST: P 44.281 /US$ (June 2008)

HIGH: P 56.341/US$ (October 2004)

LOW: P 24.2648/US$ (December 1994)

Interbank Call Loan Rate

Interbank Call Loan Rate(January 1991 to June 2008)

Latest: 5.27 % (June 2008)

High: 21.1 % (January 1998)

Low: 6.9 % (July 2003)

Sources: Bangko Sentral ng Pilipinas

91-day T-Bill Rates (Updated 18 June 2008)

91-day T-Bill Rates (Updated 18 June 2008) Latest: 3.67 % (January 2008)

High: 15.8 % (November 2000)

Low: 4.4 % (May 2002)

Mr. Mendoza recently showed some slide presentations adapted from Anton Periquet's presentations to Ayala's top brass a few weeks ago (Anton Periquet is a Deutsche Regis Partners Country Strategist). Just citing an example from last year, A lot of people in 2007 doubled their net worth overnight upon investing in stock market, mutual funds and others during the bull run of early 2007 but somehow upon reaching the late 2007 to the early 2008 a lot of the same people who invested were left with one half to one third of their net worth to losing streak. In 2007, people are thinking that they are rich because of their purchasing power but at present times people are belt tightening or afraid to invest, he asked us if the "Good Times are Over?".

People tend to ask the same old question of What now?, What do next? So people backtrack and not engage again meaning market needs excuses for movement and ask for stimulus on which inflexion point occur. The Philippine Stock Exchange Index is signalling another economic inflexion point. Mr. Mendoza reiterated that history repeats itself setting an example of 1997 Asian Financial Crisis (or Asian Flu of 1997) wherein Asian tiger economies like Japan, Singapore, Thailand, Philippines and other countries where hit hard but manage to survive the tough times and make a rebound in the process. He also pointed the psychological problem of the investor on How Long this problem will stay? Wherein there are two pre-requisites that should make the world economy stabilize on which 1.) Global Risk Appetite Normalize; 2.) Domestic Trigger Surfaces.

Along the meeting, he discussed the Virtous Cycle Unwinds that affected the world wherein there were two shocks experienced globally in late 2007 to present times. First of all is the U.S. SUBPRIME CRISIS brought about by CREDIT CRUNCH which was brought about by bad practice of lending and financing wherein they lent their money to those with poor credit (see through Investopedia). The second is OIL, in the past few months there have rising fuel prices but somehow a few days ago, the oil market and trading have recently decrease to US$ 115 per barrel and I am hoping it will go down sharply. The two shocks affected our real estate buyers from abroad specifically the Filipino-Americans who were our main investors but here in the Philippines and other overseas Filipinos from other parts of the world are not affected by the U.S. Subprime Crisis because our local banks are asking for primary collaterals (land titles, bank certificates, stock certificates etc) before issuing and approving a client a loan (very strict rules) so it is a different story from what is happening in the U.S. wherein the lenders can lend you money as long you are breathing with no collateral before the housing bubble burst.

There is a growing consciousness among the public in investing in real estate to hedge against inflation wherein a property is still the best option in long terms with capital appreciation. Right now mortgage rates from banks remains low with major banks competing in giving the lowest rates to potential customers, Peso - Dollar Exchange Rate is still stable and positive economic outlook in 2009 and Filipinos as most Asians regard property as a primary investments.

There maybe crisis in these rough times but some people see opportunities in times ahead.

"THERE IS NO FUTURE IN SHORT TERM".

No comments:

Post a Comment